Whitbread Plans £1 Billion Sale and Leaseback Strategy to Drive Expansion

Whitbread, the parent company of Premier Inn, has announced intentions to execute a sale and leaseback of at least £1 billion of its mature properties to facilitate future growth in a challenging UK hotel market.

The company expressed confidence in the favorable property investment climate, asserting that the revenue generated from these sales would be instrumental in supporting future growth initiatives and enhancing financial returns.

Dominic Paul, the chief executive officer, noted the company has been acquiring more freehold property and indicated that, following the recycling of this £1 billion, the company would maintain a balanced freehold/leasehold ratio similar to its current structure.

He also highlighted the flexibility inherent in their sale-and-leaseback strategy, stating, “If we wish to reinvest more to capitalize on higher-yield growth prospects, we have the capacity to do so.”

This strategy is part of Paul’s five-year vision aimed at returning over £2 billion to shareholders and boosting profits by a minimum of £300 million by the year 2030. He cited the significant progress already achieved towards these goals, which has led to the announcement of a £250 million share buyback alongside the company’s full-year results.

For its financial year ending February 27, the FTSE 100 company reported a modest 1 percent decline in revenues, totaling £2.92 billion, aligning with market expectations.

Sales within the Premier Inn segment in the UK experienced a 3 percent dip to £2.69 million, with revenue per available room—a critical industry performance measure—dropping by 2 percent to £64.42. The downturn was attributed to reduced demand, slow supply growth, and the effects of restructuring within their restaurant division.

The impact of this restructuring, first disclosed last year, affected adjusted profits as anticipated, contributing to a 14 percent decrease to £483 million. Pre-tax statutory profits also fell by 19 percent to £368 million.

However, it is anticipated that the temporary profit setback will be fully recovered in the current year.

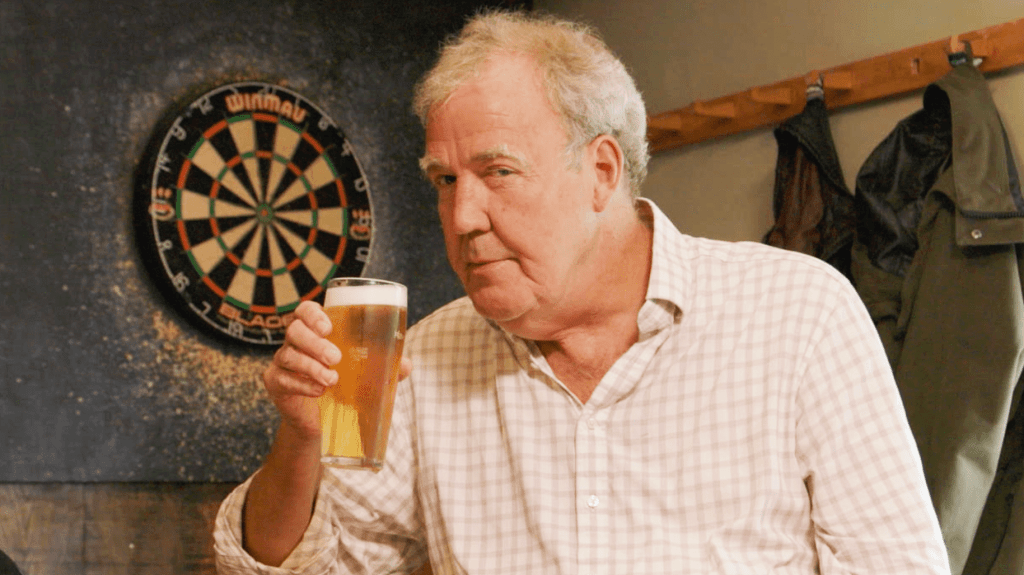

Whitbread’s restaurant sector, primarily encompassing the Beefeater and Brewers Fayre brands, is engaged in a £500 million four-year overhaul initiated by Paul to address previous performance issues. This strategy includes converting 112 restaurants into 3,500 new hotel rooms and divesting 126 restaurant locations.

In the previous year, Whitbread successfully added 1,075 new rooms in the UK, culminating in a total portfolio of 85,984 rooms across 852 hotels. The company aspires to open up to 1,200 new rooms in the UK this year, aiming for a total of 98,000 rooms by the end of the decade.

Recent trading performance indicated a 1 percent decline in total accommodation sales over the seven weeks leading up to April 17, although analysts from Shore Capital noted this decline may be slightly less severe than anticipated. Additionally, forward bookings exceeded those of the same time last year.

Paul referred to a “breakthrough year” for Premier Inn in Germany, where revenues surged by 21 percent to £231 million, successfully attracting both local and international visitors. This growth has substantially reduced headline pre-tax losses to £11 million from £36 million the prior year. Whitbread forecasts an adjusted profit between £5 million and £10 million in Germany this year, with a robust pipeline committed to an additional 18,230 rooms.

Paul stated, “We are experiencing rapid growth, achieving high guest satisfaction rates, outpacing market performance, and our established hotel segment is on track for double-digit returns.”

Founded in 1742 by Samuel Whitbread as a brewery, the company divested its beer operations in 1999. Presently, it employs 38,000 individuals and sold its Costa Coffee chain to Coca-Cola for £3.9 billion in early 2019, marking its entry into the German market in 2016.

Shares of Whitbread initially rose by as much as 8 percent in early trading but later settled to an increase of 86p, or 3.3 percent, reaching £26.79 by mid-morning.

Post Comment